Gann Analysis Results

Technical analysis using Gann theory. Result: Market trend, Market pivot date, Support & Resistance, Square of price & time, Matching price & time and Aspects.

By having a subscription, you will have unlimited access to all analysis, signals, information and features. Membership Plans

AUDCAD Forex Is Free

Australian Dollar/Canadian Dollar

The difference of the roots (0.47) with the important number; Number: 0.236 - Source: Important Ratio

The difference of the roots (0.47) with the important number; Number: 0.382 - Source: Important Ratio

The difference of the roots (0.47) with the important number; Number: 0.618 - Source: Important Ratio

The difference of the roots (0.47) with the important number; Number: 0.485 - Source: Important Square Root

The difference of the roots (0.47) with the important number; Number: 0.447 - Source: Sacred Geometry (Special)

Matching 85 degree motion with the important number; Number: 86 - Source: 0.236 of a year

Bullish Trend

1D / Long Term Fire at will

1D / Long Term Fire at will

Pivot Date: 09/28/2023 (210 days ago)

The use of resistance lines is suggested

| Degree | Support | Resistance |

|---|---|---|

| 45º | 0.84243 | 0.87170 |

| 90º | 0.82798 | 0.88652 |

| 135º | 0.81365 | 0.90147 |

| 180º | 0.79945 | 0.91655 |

| 225º | 0.78538 | 0.93175 |

| 270º | 0.77143 | 0.94707 |

| 315º | 0.75760 | 0.96252 |

| 360º | 0.74390 | 0.97810 |

Start Date: 01/26/2023

End Date: 09/28/2023

Price High: 0.95489 ⟶ 81°

Price Low: 0.85668 ⟶ 0°

Price Range: 0.1 ⟶ 315°

Work Day: 175 ⟶ 353°

Calendar Day: 245 ⟶ 67°

End Date: 09/28/2023

Price High: 0.95489 ⟶ 81°

Price Low: 0.85668 ⟶ 0°

Price Range: 0.1 ⟶ 315°

Work Day: 175 ⟶ 353°

Calendar Day: 245 ⟶ 67°

The difference of the roots (0.47) with the important number; Number: 0.236 - Source: Important Ratio

The difference of the roots (0.47) with the important number; Number: 0.382 - Source: Important Ratio

The difference of the roots (0.47) with the important number; Number: 0.618 - Source: Important Ratio

The difference of the roots (0.47) with the important number; Number: 0.485 - Source: Important Square Root

The difference of the roots (0.47) with the important number; Number: 0.447 - Source: Sacred Geometry (Special)

Matching 85 degree motion with the important number; Number: 86 - Source: 0.236 of a year

AUDCAD Forex Is Free

Australian Dollar/Canadian Dollar

Matching 10 degree motion with the important number; Number: 8 - Source: Fibonacci

Matching 10 degree motion with the important number; Number: 9 - Source:

Matching 10 degree motion with the important number; Number: 11 - Source: Lucas Number

Bullish Trend

4H / Medium Term Ongoing trend

4H / Medium Term Ongoing trend

Pivot Date: 04/01/2024 (24 days ago)

The use of resistance lines is suggested

| Degree | Support | Resistance |

|---|---|---|

| 45º | 0.87878 | 0.88174 |

| 90º | 0.87730 | 0.88323 |

| 135º | 0.87582 | 0.88472 |

| 180º | 0.87434 | 0.88620 |

| 225º | 0.87286 | 0.88769 |

| 270º | 0.87138 | 0.88918 |

| 315º | 0.86991 | 0.89067 |

| 360º | 0.86843 | 0.89217 |

Start Date: 03/08/2024

End Date: 04/01/2024

Price High: 0.8945 ⟶ 27°

Price Low: 0.88026 ⟶ 18°

Price Range: 0.01 ⟶ 0°

Work Day: 16 ⟶ 112°

Calendar Day: 24 ⟶ 292°

End Date: 04/01/2024

Price High: 0.8945 ⟶ 27°

Price Low: 0.88026 ⟶ 18°

Price Range: 0.01 ⟶ 0°

Work Day: 16 ⟶ 112°

Calendar Day: 24 ⟶ 292°

Matching 10 degree motion with the important number; Number: 8 - Source: Fibonacci

Matching 10 degree motion with the important number; Number: 9 - Source:

Matching 10 degree motion with the important number; Number: 11 - Source: Lucas Number

EURCAD Forex Is Free

Euro / Canadian Dollar

The difference of the roots (0.93) with the important number; Number: 0.618 - Source: Important Ratio

The difference of the roots (0.93) with the important number; Number: 0.786 - Source: Important Ratio

The difference of the roots (0.93) with the important number; Number: 0.886 - Source: Important Square Root

The difference of the roots (0.93) with the important number; Number: 0.707 - Source: Sacred Geometry (Special)

Matching 167 degree motion with the important number; Number: 169 - Source: 3*13

Bearish Trend

1D / Long Term Ongoing trend

1D / Long Term Ongoing trend

Pivot Date: 04/26/2023 (365 days ago)

The use of support lines is suggested

| Degree | Support | Resistance |

|---|---|---|

| 45º | 1.49163 | 1.53050 |

| 90º | 1.47238 | 1.55012 |

| 135º | 1.45326 | 1.56987 |

| 180º | 1.43426 | 1.58974 |

| 225º | 1.41538 | 1.60974 |

| 270º | 1.39664 | 1.62986 |

| 315º | 1.37801 | 1.65011 |

| 360º | 1.35951 | 1.67049 |

Start Date: 08/26/2022

End Date: 04/26/2023

Price High: 1.51132 ⟶ 180°

Price Low: 1.28826 ⟶ 180°

Price Range: 0.22 ⟶ 247°

Work Day: 172 ⟶ 334°

Calendar Day: 243 ⟶ 56°

End Date: 04/26/2023

Price High: 1.51132 ⟶ 180°

Price Low: 1.28826 ⟶ 180°

Price Range: 0.22 ⟶ 247°

Work Day: 172 ⟶ 334°

Calendar Day: 243 ⟶ 56°

The difference of the roots (0.93) with the important number; Number: 0.618 - Source: Important Ratio

The difference of the roots (0.93) with the important number; Number: 0.786 - Source: Important Ratio

The difference of the roots (0.93) with the important number; Number: 0.886 - Source: Important Square Root

The difference of the roots (0.93) with the important number; Number: 0.707 - Source: Sacred Geometry (Special)

Matching 167 degree motion with the important number; Number: 169 - Source: 3*13

EURCAD Forex Is Free

Euro / Canadian Dollar

The difference of the roots (0.12) with the important number; Number: 0.146 - Source: Important Ratio

The difference of the roots (0.12) with the important number; Number: 0.236 - Source: Important Ratio

Matching 22 degree motion with the important number; Number: 21 - Source: Fibonacci

Matching 22 degree motion with the important number; Number: 2.236 - Source: Sacred Geometry (Special)

Bullish Trend

4H / Medium Term Fire at will

4H / Medium Term Fire at will

Pivot Date: 04/02/2024 (23 days ago)

The use of resistance lines is suggested

| Degree | Support | Resistance |

|---|---|---|

| 45º | 1.45249 | 1.45676 |

| 90º | 1.45036 | 1.45889 |

| 135º | 1.44824 | 1.46103 |

| 180º | 1.44611 | 1.46317 |

| 225º | 1.44398 | 1.46530 |

| 270º | 1.44186 | 1.46745 |

| 315º | 1.43974 | 1.46959 |

| 360º | 1.43762 | 1.47173 |

Start Date: 03/19/2024

End Date: 04/02/2024

Price High: 1.47796 ⟶ 157°

Price Low: 1.45463 ⟶ 135°

Price Range: 0.02 ⟶ 45°

Work Day: 10 ⟶ 337°

Calendar Day: 14 ⟶ 67°

End Date: 04/02/2024

Price High: 1.47796 ⟶ 157°

Price Low: 1.45463 ⟶ 135°

Price Range: 0.02 ⟶ 45°

Work Day: 10 ⟶ 337°

Calendar Day: 14 ⟶ 67°

The difference of the roots (0.12) with the important number; Number: 0.146 - Source: Important Ratio

The difference of the roots (0.12) with the important number; Number: 0.236 - Source: Important Ratio

Matching 22 degree motion with the important number; Number: 21 - Source: Fibonacci

Matching 22 degree motion with the important number; Number: 2.236 - Source: Sacred Geometry (Special)

USDCAD Forex Is Free

U.S. Dollar / Canadian Dollar

The difference of the roots (0.3) with the important number; Number: 0.236 - Source: Important Ratio

The difference of the roots (0.3) with the important number; Number: 0.382 - Source: Important Ratio

The difference of the roots (0.3) with the important number; Number: 0.447 - Source: Sacred Geometry (Special)

Matching 54 degree motion with the important number; Number: 55 - Source: Fibonacci

Bullish Trend

1D / Long Term Fire at will

1D / Long Term Fire at will

Pivot Date: 01/27/2023 (454 days ago)

The use of resistance lines is suggested

| Degree | Support | Resistance |

|---|---|---|

| 45º | 1.31111 | 1.32437 |

| 90º | 1.30451 | 1.33102 |

| 135º | 1.29793 | 1.33769 |

| 180º | 1.29136 | 1.34438 |

| 225º | 1.28480 | 1.35108 |

| 270º | 1.27827 | 1.35780 |

| 315º | 1.27175 | 1.36453 |

| 360º | 1.26525 | 1.37129 |

Start Date: 10/31/2023

End Date: 12/27/2023

Price High: 1.38923 ⟶ 90°

Price Low: 1.31774 ⟶ 37°

Price Range: 0.07 ⟶ 225°

Work Day: 40 ⟶ 180°

Calendar Day: 57 ⟶ 45°

End Date: 12/27/2023

Price High: 1.38923 ⟶ 90°

Price Low: 1.31774 ⟶ 37°

Price Range: 0.07 ⟶ 225°

Work Day: 40 ⟶ 180°

Calendar Day: 57 ⟶ 45°

The difference of the roots (0.3) with the important number; Number: 0.236 - Source: Important Ratio

The difference of the roots (0.3) with the important number; Number: 0.382 - Source: Important Ratio

The difference of the roots (0.3) with the important number; Number: 0.447 - Source: Sacred Geometry (Special)

Matching 54 degree motion with the important number; Number: 55 - Source: Fibonacci

XAUUSD Metals Is Free

Gold / U.S. Dollar

The difference of the roots (1.88) with the important number; Number: 1.27 - Source: Important Ratio

The difference of the roots (1.88) with the important number; Number: 1.618 - Source: Important Ratio

The difference of the roots (1.88) with the important number; Number: 2.618 - Source: Important Ratio

The difference of the roots (1.88) with the important number; Number: 1.12 - Source: Important Square Root

The difference of the roots (1.88) with the important number; Number: 2.058 - Source: Important Square Root

The difference of the roots (1.88) with the important number; Number: 1.414 - Source: Sacred Geometry (Special)

The difference of the roots (1.88) with the important number; Number: 1.73 - Source: Sacred Geometry (Special)

The difference of the roots (1.88) with the important number; Number: 1.9 - Source: Sacred Geometry (Special)

The difference of the roots (1.88) with the important number; Number: 1.272 - Source: Sacred Geometry (Special)

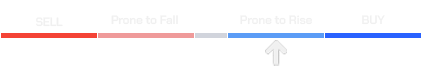

Prone to Fall (from the highest of a trend)

1D / Long Term On pending

1D / Long Term On pending

Pivot Date: 04/08/2024 (17 days ago)

Keep an eye on the nearest resistance line

| Degree | Support | Resistance |

|---|---|---|

| 45º | 2301.056 | 2409.569 |

| 90º | 2247.737 | 2464.763 |

| 135º | 2195.043 | 2520.582 |

| 180º | 2142.975 | 2577.025 |

| 225º | 2091.531 | 2634.094 |

| 270º | 2040.712 | 2691.788 |

| 315º | 1990.518 | 2750.107 |

| 360º | 1940.949 | 2809.051 |

Start Date: 10/05/2023

End Date: 04/08/2024

Price High: 2354.16 ⟶ 11°

Price Low: 1813.03 ⟶ 32°

Price Range: 541.13 ⟶ 11°

Work Day: 129 ⟶ 15°

Calendar Day: 186 ⟶ 64°

End Date: 04/08/2024

Price High: 2354.16 ⟶ 11°

Price Low: 1813.03 ⟶ 32°

Price Range: 541.13 ⟶ 11°

Work Day: 129 ⟶ 15°

Calendar Day: 186 ⟶ 64°

The difference of the roots (1.88) with the important number; Number: 1.27 - Source: Important Ratio

The difference of the roots (1.88) with the important number; Number: 1.618 - Source: Important Ratio

The difference of the roots (1.88) with the important number; Number: 2.618 - Source: Important Ratio

The difference of the roots (1.88) with the important number; Number: 1.12 - Source: Important Square Root

The difference of the roots (1.88) with the important number; Number: 2.058 - Source: Important Square Root

The difference of the roots (1.88) with the important number; Number: 1.414 - Source: Sacred Geometry (Special)

The difference of the roots (1.88) with the important number; Number: 1.73 - Source: Sacred Geometry (Special)

The difference of the roots (1.88) with the important number; Number: 1.9 - Source: Sacred Geometry (Special)

The difference of the roots (1.88) with the important number; Number: 1.272 - Source: Sacred Geometry (Special)

NZDUSD Forex Is Free

New Zealand Dollar / U.S. Dollar

The difference of the roots (0.19) with the important number; Number: 0.146 - Source: Important Ratio

The difference of the roots (0.19) with the important number; Number: 0.236 - Source: Important Ratio

Matching 35 degree motion with the important number; Number: 36 - Source: 6*6

Matching 35 degree motion with the important number; Number: 34 - Source: Fibonacci

Bullish Trend

4H / Medium Term Ongoing trend

4H / Medium Term Ongoing trend

Pivot Date: 04/02/2024 (23 days ago)

The use of resistance lines is suggested

| Degree | Support | Resistance |

|---|---|---|

| 45º | 0.5917 | 0.5971 |

| 90º | 0.5890 | 0.5999 |

| 135º | 0.5863 | 0.6026 |

| 180º | 0.5835 | 0.6054 |

| 225º | 0.5808 | 0.6081 |

| 270º | 0.5782 | 0.6109 |

| 315º | 0.5755 | 0.6136 |

| 360º | 0.5728 | 0.6164 |

Start Date: 03/08/2024

End Date: 04/02/2024

Price High: 0.62081 ⟶ 101°

Price Low: 0.5944 ⟶ 67°

Price Range: 0.03 ⟶ 45°

Work Day: 17 ⟶ 135°

Calendar Day: 25 ⟶ 315°

End Date: 04/02/2024

Price High: 0.62081 ⟶ 101°

Price Low: 0.5944 ⟶ 67°

Price Range: 0.03 ⟶ 45°

Work Day: 17 ⟶ 135°

Calendar Day: 25 ⟶ 315°

The difference of the roots (0.19) with the important number; Number: 0.146 - Source: Important Ratio

The difference of the roots (0.19) with the important number; Number: 0.236 - Source: Important Ratio

Matching 35 degree motion with the important number; Number: 36 - Source: 6*6

Matching 35 degree motion with the important number; Number: 34 - Source: Fibonacci

NZDUSD Forex Is Free

New Zealand Dollar / U.S. Dollar

The difference of the roots (0.32) with the important number; Number: 0.236 - Source: Important Ratio

The difference of the roots (0.32) with the important number; Number: 0.382 - Source: Important Ratio

The difference of the roots (0.32) with the important number; Number: 0.447 - Source: Sacred Geometry (Special)

Matching 57 degree motion with the important number; Number: 55 - Source: Fibonacci

Bullish Trend

1D / Long Term Ongoing trend

1D / Long Term Ongoing trend

Pivot Date: 04/01/2024 (24 days ago)

The use of resistance lines is suggested

| Degree | Support | Resistance |

|---|---|---|

| 45º | 0.59015 | 0.59786 |

| 90º | 0.58632 | 0.60173 |

| 135º | 0.58250 | 0.60562 |

| 180º | 0.57869 | 0.60951 |

| 225º | 0.57489 | 0.61342 |

| 270º | 0.57110 | 0.61735 |

| 315º | 0.56733 | 0.62128 |

| 360º | 0.56357 | 0.62523 |

Start Date: 12/28/2023

End Date: 04/01/2024

Price High: 0.63696 ⟶ 123°

Price Low: 0.59396 ⟶ 67°

Price Range: 0.04 ⟶ 135°

Work Day: 67 ⟶ 157°

Calendar Day: 95 ⟶ 81°

End Date: 04/01/2024

Price High: 0.63696 ⟶ 123°

Price Low: 0.59396 ⟶ 67°

Price Range: 0.04 ⟶ 135°

Work Day: 67 ⟶ 157°

Calendar Day: 95 ⟶ 81°

The difference of the roots (0.32) with the important number; Number: 0.236 - Source: Important Ratio

The difference of the roots (0.32) with the important number; Number: 0.382 - Source: Important Ratio

The difference of the roots (0.32) with the important number; Number: 0.447 - Source: Sacred Geometry (Special)

Matching 57 degree motion with the important number; Number: 55 - Source: Fibonacci

.JP225Cash Equity Indexes Is Free

Nikkei 225 Cash Index

The difference of the roots (2.81) with the important number; Number: 1.618 - Source: Important Ratio

The difference of the roots (2.81) with the important number; Number: 2.618 - Source: Important Ratio

The difference of the roots (2.81) with the important number; Number: 1.12 - Source: Important Square Root

The difference of the roots (2.81) with the important number; Number: 2.058 - Source: Important Square Root

The difference of the roots (2.81) with the important number; Number: 1.9 - Source: Sacred Geometry (Special)

The difference of the roots (2.81) with the important number; Number: 2.236 - Source: Sacred Geometry (Special)

Bearish Trend

1D / Long Term Ongoing trend

1D / Long Term Ongoing trend

Pivot Date: 03/22/2024 (34 days ago)

The use of support lines is suggested

| Degree | Support | Resistance |

|---|---|---|

| 45º | 39937.91 | 42157.09 |

| 90º | 38850.81 | 43289.19 |

| 135º | 37778.72 | 44436.28 |

| 180º | 36721.62 | 45598.38 |

| 225º | 35679.53 | 46775.47 |

| 270º | 34652.43 | 47967.57 |

| 315º | 33640.34 | 49174.66 |

| 360º | 32643.24 | 50396.76 |

Start Date: 10/27/2023

End Date: 03/22/2024

Price High: 41078 ⟶ 180°

Price Low: 30504.8 ⟶ 35°

Price Range: 10573.2 ⟶ 180°

Work Day: 90 ⟶ 36°

Calendar Day: 147 ⟶ 150°

End Date: 03/22/2024

Price High: 41078 ⟶ 180°

Price Low: 30504.8 ⟶ 35°

Price Range: 10573.2 ⟶ 180°

Work Day: 90 ⟶ 36°

Calendar Day: 147 ⟶ 150°

The difference of the roots (2.81) with the important number; Number: 1.618 - Source: Important Ratio

The difference of the roots (2.81) with the important number; Number: 2.618 - Source: Important Ratio

The difference of the roots (2.81) with the important number; Number: 1.12 - Source: Important Square Root

The difference of the roots (2.81) with the important number; Number: 2.058 - Source: Important Square Root

The difference of the roots (2.81) with the important number; Number: 1.9 - Source: Sacred Geometry (Special)

The difference of the roots (2.81) with the important number; Number: 2.236 - Source: Sacred Geometry (Special)

GBPCAD Forex Is Free

British Pound / Canadian Dollar

The difference of the roots (0.38) with the important number; Number: 0.236 - Source: Important Ratio

The difference of the roots (0.38) with the important number; Number: 0.382 - Source: Important Ratio

The difference of the roots (0.38) with the important number; Number: 0.485 - Source: Important Square Root

The difference of the roots (0.38) with the important number; Number: 0.447 - Source: Sacred Geometry (Special)

Matching 69 degree motion with the important number; Number: 6.854 - Source: Important Ratio

Bearish Trend

1D / Long Term Ongoing trend

1D / Long Term Ongoing trend

Pivot Date: 03/11/2024 (45 days ago)

The use of support lines is suggested

| Degree | Support | Resistance |

|---|---|---|

| 45º | 1.72485 | 1.74568 |

| 90º | 1.71448 | 1.75614 |

| 135º | 1.70415 | 1.76663 |

| 180º | 1.69384 | 1.77716 |

| 225º | 1.68357 | 1.78771 |

| 270º | 1.67333 | 1.79830 |

| 315º | 1.66312 | 1.80891 |

| 360º | 1.65294 | 1.81956 |

Start Date: 09/28/2023

End Date: 03/11/2024

Price High: 1.73526 ⟶ 347°

Price Low: 1.63585 ⟶ 277°

Price Range: 0.1 ⟶ 337°

Work Day: 115 ⟶ 261°

Calendar Day: 165 ⟶ 285°

End Date: 03/11/2024

Price High: 1.73526 ⟶ 347°

Price Low: 1.63585 ⟶ 277°

Price Range: 0.1 ⟶ 337°

Work Day: 115 ⟶ 261°

Calendar Day: 165 ⟶ 285°

The difference of the roots (0.38) with the important number; Number: 0.236 - Source: Important Ratio

The difference of the roots (0.38) with the important number; Number: 0.382 - Source: Important Ratio

The difference of the roots (0.38) with the important number; Number: 0.485 - Source: Important Square Root

The difference of the roots (0.38) with the important number; Number: 0.447 - Source: Sacred Geometry (Special)

Matching 69 degree motion with the important number; Number: 6.854 - Source: Important Ratio

AUDUSD Forex Is Free

Australian Dollar / U.S. Dollar

The difference of the roots (0.24) with the important number; Number: 0.146 - Source: Important Ratio

The difference of the roots (0.24) with the important number; Number: 0.236 - Source: Important Ratio

The difference of the roots (0.24) with the important number; Number: 0.382 - Source: Important Ratio

Matching 44 degree motion with the important number; Number: 44 - Source: Fibonacci

Matching 44 degree motion with the important number; Number: 45 - Source: 0.125 of a year

Matching 44 degree motion with the important number; Number: 0.447 - Source: Sacred Geometry (Special)

Prone to Rise (from the lowest of a trend)

1D / Long Term On pending

1D / Long Term On pending

Pivot Date: 04/02/2024 (23 days ago)

Keep an eye on the nearest support line

| Degree | Support | Resistance |

|---|---|---|

| 45º | 0.64534 | 0.65134 |

| 90º | 0.64235 | 0.65435 |

| 135º | 0.63936 | 0.65737 |

| 180º | 0.63639 | 0.66039 |

| 225º | 0.63342 | 0.66342 |

| 270º | 0.63045 | 0.66646 |

| 315º | 0.62750 | 0.66951 |

| 360º | 0.62455 | 0.67256 |

Start Date: 12/29/2023

End Date: 04/02/2024

Price High: 0.68464 ⟶ 168°

Price Low: 0.64831 ⟶ 135°

Price Range: 0.04 ⟶ 45°

Work Day: 66 ⟶ 146°

Calendar Day: 95 ⟶ 81°

End Date: 04/02/2024

Price High: 0.68464 ⟶ 168°

Price Low: 0.64831 ⟶ 135°

Price Range: 0.04 ⟶ 45°

Work Day: 66 ⟶ 146°

Calendar Day: 95 ⟶ 81°

The difference of the roots (0.24) with the important number; Number: 0.146 - Source: Important Ratio

The difference of the roots (0.24) with the important number; Number: 0.236 - Source: Important Ratio

The difference of the roots (0.24) with the important number; Number: 0.382 - Source: Important Ratio

Matching 44 degree motion with the important number; Number: 44 - Source: Fibonacci

Matching 44 degree motion with the important number; Number: 45 - Source: 0.125 of a year

Matching 44 degree motion with the important number; Number: 0.447 - Source: Sacred Geometry (Special)

AUDUSD Forex Is Free

Australian Dollar / U.S. Dollar

The difference of the roots (0.12) with the important number; Number: 0.146 - Source: Important Ratio

The difference of the roots (0.12) with the important number; Number: 0.236 - Source: Important Ratio

Matching 22 degree motion with the important number; Number: 21 - Source: Fibonacci

Matching 22 degree motion with the important number; Number: 2.236 - Source: Sacred Geometry (Special)

Prone to Rise (from the lowest of a trend)

4H / Medium Term On pending

4H / Medium Term On pending

Pivot Date: 04/02/2024 (23 days ago)

Keep an eye on the nearest support line

| Degree | Support | Resistance |

|---|---|---|

| 45º | 0.64659 | 0.65003 |

| 90º | 0.64488 | 0.65175 |

| 135º | 0.64317 | 0.65347 |

| 180º | 0.64146 | 0.65519 |

| 225º | 0.63975 | 0.65692 |

| 270º | 0.63805 | 0.65865 |

| 315º | 0.63635 | 0.66038 |

| 360º | 0.63465 | 0.66211 |

Start Date: 03/08/2024

End Date: 04/01/2024

Price High: 0.66677 ⟶ 157°

Price Low: 0.64831 ⟶ 135°

Price Range: 0.02 ⟶ 0°

Work Day: 17 ⟶ 135°

Calendar Day: 25 ⟶ 315°

End Date: 04/01/2024

Price High: 0.66677 ⟶ 157°

Price Low: 0.64831 ⟶ 135°

Price Range: 0.02 ⟶ 0°

Work Day: 17 ⟶ 135°

Calendar Day: 25 ⟶ 315°

The difference of the roots (0.12) with the important number; Number: 0.146 - Source: Important Ratio

The difference of the roots (0.12) with the important number; Number: 0.236 - Source: Important Ratio

Matching 22 degree motion with the important number; Number: 21 - Source: Fibonacci

Matching 22 degree motion with the important number; Number: 2.236 - Source: Sacred Geometry (Special)